Weekly Market Highlights #27: December 26 - January 1

✨The year 2022, full of milestones, has ended with another gloomy trading week when most projects and investors have not returned from the holiday.

✨Over the past week, the crypto market decreased ~$8B (from ~$813B to ~$805B) of its total capitalization

✨Bitcoin Stalls at $16.5K

✅In 2022, Bitcoin started on a high note at almost $50K but ended 65% lower following a violent year that saw multiple collapses.

✅For the past few weeks, Bitcoin has lacked any substantial price movements. BTC has been stuck between $16K and $17K since the failed attempt to overcome $18K on December 14.

✅ 2022's final hours didn't deliver any price fluctuations either, and bitcoin remained stuck at around $16,500. The start of the new year is yet to make its mark, although there're some worrying predictions from analysts claiming that the asset could drop even further based on the whales' behavior.

✨Altcoins are less volatile

✅BSCS is currently trading at ~$0,008379: +5,50% from its 7-day all-time low of $0,007943.

✅ETH dipped below $1,2K a few days ago and has failed to reclaim that level ever since.

✅BNB, ADA, DOGE, MATIC, DOT, TRX, and SHIB have all slipped by under 1% in a day.

✅OKB and TON are among the best performers today, as they were yesterday. OKB is up by 4% and sits at $27. TON jumped by 5% (~$2.2)

✅NEXO has gained the most from the top 100 crypto assets by market cap, with a massive 15% daily surge. As such, the lender's native token has neared $0.7.

✨Bitcoin Fear and Greed Index is 27 - Fear, lower than at the beginning of the week (28)

✨Dominance:

✅BTC: 39.9%

✅ETH: 18.4%

The Nineteenth BSCS Token Burning Event

BSCStation has completed the 19th burning of 102,880 BSCS tokens. Now the total supply is: 399,946,993 BSCS.

✅ Detailed transaction: https://bscscan.com/tx/0x1ac6e43593cf477f5ed26d8217dc4ac55bcb6ac374b324aa46e4ac7cd7ef7062

✅ BSCS were burned via smart contract: 0x0000000000000000000000000000000000000000

💥 As promised, we will continue burning BSCS tokens monthly until the total supply reaches 100M BSCS.

▶ Alongside the token burn, BSCStation is REMOVING and LOCKING-UP a total of 100M tokens from circulation to ensure the optimal value for our token.

🎗 BSCS Holders are granted numerous privileges and benefits when accessing BSCStation. We will constantly improve to provide more benefits to our beloved community, so don't hesitate to become our BSCS Holders, and you will be well rewarded!

Billionaire Investor Bill Miller Sees Fresh Opportunities for Bitcoin Amid Sell-off

💎Legendary investor Bill Miller continues bullish on Bitcoin despite the crypto asset being hit by a brutal sell-off this year.

▶️The Baltimore investing giant rose to prominence by outperforming the S&P 500 annually from 1991 to 2005. He subsequently served as the chairman and chief investment officer of Miller Value Partners, which had $1.9 billion in assets under management at the end of August 2022.

⭐️Despite announcing his retirement recently, Bitcoin remains one of his signature bets.

✔️In an interview with Barron’s, the 72-year-old billionaire reiterated his optimistic stance and said Bitcoin remains one of his top personal holdings. Miller sees cryptocurrency as a potential store of value, much like digital gold.

✔️The FTX bankruptcy caused severe disruption in the market and proved to be a catalyzing agent for the crypto winter.

✔️Miller, for one, said he is surprised that Bitcoin “is not at half of its current price” given the high-profile implosion. He considers the asset’s price hovering near $17,000 to be “remarkable,” supposing many players have “fled” the scene to recover from the losses.

✔️The fund manager further projected that the flagship crypto-asset would likely perform better once the Federal Reserve slows down its monetary policy.

The Republic of Palau is working with Ripple to create a ‘national stablecoin’

⭐️The Republic of Palau, with its president Surangel S. Whipps Jr., stated that the country’s IT team was actively working with blockchain company Ripple Labs, exploring the possibility of launching a “national stablecoin,”

Palau’s digital asset strategy

✔️The president of the archipelago of over 500 islands explained that such a small country had to diversify its economy, look at ways in which it could be more innovative, and “take advantage of new technologies,” referring to the passing of the Digital Residency Act as one of the examples of these efforts.

✔️The president added: “Palau is also taking a step in collaborating with Ripple to explore the creation of national stablecoin, which we hope to launch soon, and which will help make payments easy and secure.”

✔️Whipps Jr. highlighted the support from Binance CEO Changpeng Zhao, who visited Palau and discussed the possible collaboration on the digital residency program, “as well as using Binance Pay to make digital payments for digital residents, but also participating in the local commerce.”

✔️The president of Palau stressed that he had a virtual meeting with Ethereum co-founder Vitalik Buterin and discussed the option of opening up the R&S ID ecosystem to the developer community and “see how Palau’s digital residency can engage with the concept of so-bound ID systems.”

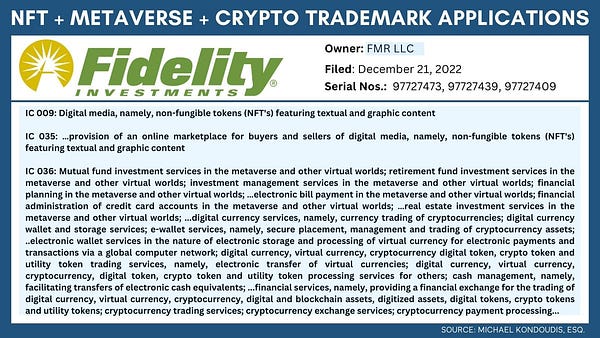

Fidelity to Enter The Metaverse With Latest Trademark Applications

Investment giant Fidelity is showing little fear of the bears with its latest trademark applications. The firm is keen to tap into the Metaverse and NFTs.

📢On Dec. 27, licensed trademark attorney Mike Kondoudis revealed the latest crypto trademark applications from Fidelity Investments.

💎Three applications were filed broadly covering Metaverse technologies and services, NFTs and marketplaces, virtual land, and cryptocurrency trading.

Crypto Trademarks Sought by Fidelity

✔️Fidelity wants to offer its services in the Metaverse rather than build its Metaverse. The third trademark application included mutual fund investment services, retirement fund investment services, investment management, financial planning, and electronic bill payment in the Metaverse and other virtual worlds.

✔️It mentions digital currency services, crypto trading, wallets, storage, and custody.

✔️Fidelity is one of America's largest pension providers, and it allowed investors to include Bitcoin in their pension plans earlier this year.

✔️In November, the asset manager's crypto unit Fidelity Digital Assets, allowed its retail clients to invest in Bitcoin and Ethereum. Despite this year's bear market, the firm is still keen on the asset class and related web3 technologies.

✔️On Dec. 23, international banking giant HSBC filed trademark applications for its name and logo. They include provisions for NFTs, crypto exchange and transfer, and Metaverse credit card processing.

MicroStrategy Adds 2500 Net Bitcoin To Its Portfolio

MicroStrategy has spent around $4.03 billion to accumulate its entire bitcoin stash.

💎The American business intelligence corporation – MicroStrategy – bought 3,205 BTC between November 1 and December 24.

⭐️The company sold 704 BTC on December 22, meaning its total holdings currently stand at 132,251 BTC.

✔️The largest BTC corporate holder – MicroStrategy – continues following its bitcoin agenda purchasing more amounts of the primary cryptocurrency.

✔️It acquired 2,395 BTC for approximately $42.8 million (~$17,871 per BTC) between the beginning of November and December 21.

✔️The firm sold 704 BTC on December 22 for nearly $12 million to cover previous capital losses.

✔️On Christmas Eve, MicroStrategy bought an additional 810 BTC for $13.6 million, bringing its total owning to 132,251 BTC (equaling about $2.2 billion at current prices).

✔️Michael Saylor – Executive Chairman – announced the news his Twitter account, saying the organization spent a little over $4 billion.

MicroStrategy to Introduce Bitcoin Lightning Applications Next Year

MicroStrategy’s Executive Chairman – Michael Saylor – said the company intends to roll out Bitcoin Lightning Network-powered solutions and applications next year.

The business intelligence firm previously planned to launch an enterprise Lightning Wallet and Lightning servers and was looking to hire a software engineer to be in charge.

Presenting the 2023 Plans

⭐️Saylor revealed the firm’s intentions on Twitter Spaces, saying MicroStrategy is exploring ways to integrate Lightning Network solutions. As such, the company could enable consumers to process faster, cheaper, and more efficient bitcoin transactions.

⭐️The Executive Chairman suggested that businesses could employ the Lightning Network to stimulate clients by giving them small amounts of bitcoin (satoshis) when they apply for certain online services. The reward campaign could reach millions of users, he added.

⭐️Saylor also claimed that the rollout of a Lightning Network Wallet could take part in Internet security. For example, individuals visiting dubious web pages could deposit “100,000” satoshis (around $17 at current prices) to protect themselves from cyber threats. The assets would be restored once users complete their website visit.

⭐️MicroStrategy aims to spread the Lightning Network applications in the first quarter of 2023, believing it could target millions:

“We want to make it possible for any enterprise to spin up a Lighting wallet and a Lightning wallet architecture in an afternoon and deploy it to thousands or millions of people.”

📣Stay tuned! The market's highlights will be updated by BSCStation 😎

About BSCStation

BSCStation - The fully decentralized protocol for launching new ideas. An all-in-one Incubation Hub with a full-stack Defi platform across all main blockchain networks. We provide exclusive services including IDO/INO Launchpad, Yield farming, NFT Auction, Marketplace, and BSCSwap

BSCStation operates on top of the all main blockchain networks and is designed to offer maximum value to consumers and institutions.

BSCStation platform uses the Sharing Economy Model for the purpose of profit-sharing, helping users to access DeFi platforms in the easiest, safest, and most cost-effective way. BSCStation is the most convenient bridge to connect users and application products on all main blockchain networks.